A graphical analysis of the economic model of WON and its return on investment.

WON exists as the quantitative value of the entire WeBlock system, so the performance of WON is closely related to WeBlock’s overall business operation and its accelerated investment portfolio strategy. Therefore, the analysis and discussion of the intrinsic value of WON will be the focus of this article. This is also an attempt to break down why WON is a digital currency worth holding for a long time in a responsible attitude to users and investors who already or will hold WON.

First of all, this article does not intend to use a very scientific and rigorous data method to describe the value of WON. If you are interested in this kind of information, you are welcome to read our white paper on our homepage. This article mainly explains the applicability and value-growing feature of WON from the economic and financial aspects by using diagram.

Before we drive into WON, we shall understand first what WeBlock ecosystem, because the operation of Weblock will reflects its performance on WON.

What’s Weblock ecosystem?

In total, WeBlock is divided into 6 complementing each other eco-system services. Each service corresponds to a critical path node of the developing project in the acceleration business model. The control and optimization of each critical path node is the most important manifestation of the core value of WeBlock ecosystem service.

What worthy to mention is, that every product is born with the mission of creating value and generating revenue, so each product in the WeBlock ecosystem can independently create profits. This ensures that the products are compatible with each other while ensuring financial sustainability.

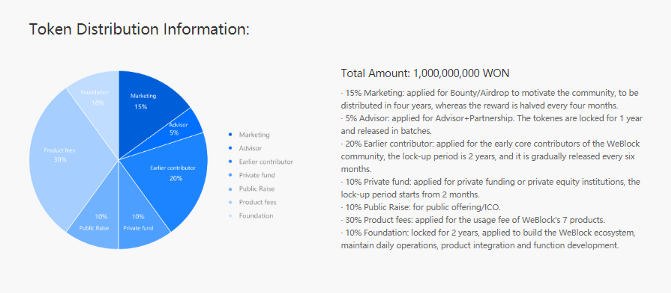

And WON, issued by WeBlock community, is the only token used in the WeBlock ecosystem.

What About WON?

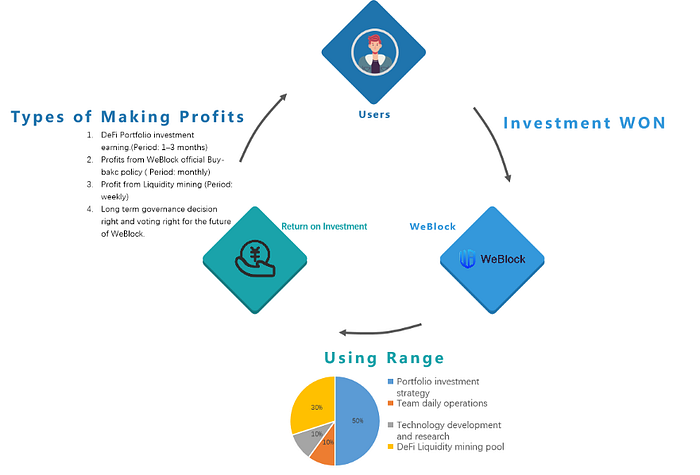

Regarding WON, we combine users, investment in WON and income according to three dimensions, and operate through a series of combination strategies to achieve a sustainable cycle of mutual balance between the three dimensions and the economic appreciation come from the sustainable cycle.

As you can see from the diagram, every time a user invests in a WON and acquires the ownership of the WON, WeBlock will inject the user’s investment proportionally into the following aspects:

1. Portfolio investment strategy (50%) : Used to invest in different Defi projects in the WeBlock acceleration ecosystem.

2. Team daily operations(10%): Used to keep the team running and related marketing promotion.

3. Technology development and research (10%): Used to update and optimize the current products.

4. DeFi Liquidity mining pool (30%): Used to earn passive revenue daily.

Regarding the above-mentioned proportional distribution of these investment portfolios, we make a judgment based on the current performance of the DeFi market data, and are used to hedge the risks brought by users in mainstream digital currency investments.

For the allocation of our capital use portfolio, the WON held by the user can expect to obtain profit from the following aspects:

1. DeFi Portfolio investment earning.(Period: 1–3 months)

2. Profits from WeBlock official Buy-bakc policy ( Period: monthly)

3. Profit from Liquidity mining (Period: weekly)

4. Long term governance decision right and voting right for the future of WeBlock.

When the user obtains profits from different periods, these profits will be actually reflected in the WON held by the user, and then the user can choose to sell and buy WON periodically to achieve a sustainable profit model.

Contact Us:

Twitter | Telegram | Medium | Official Website